By Lars Jensen

The Great Bitcoin Lie: Pseudonymity vs. Anonymity

There is a dangerous misconception that pervades the crypto gambling community, even in 2026. It is the belief that Bitcoin is anonymous. Let me be the one to shatter that illusion: Bitcoin is perhaps the most transparent financial surveillance tool ever invented.

When you deposit Bitcoin into a casino, you are not just sending money; you are sending a permanent, immutable history of your entire financial life. Every Satoshi you hold can be traced back to its source—whether that’s a KYC-verified exchange like Coinbase, a mined block, or a mixed transaction. Blockchain analytics firms like Chainalysis and Elliptic have mapped billions of addresses. If you send BTC from a wallet linked to your identity (via a centralized exchange) to a crypto casino, you have effectively handed over your bank statement to anyone with the right software.

For the casual punter, this might not matter. But for the high-roller, the privacy advocate, or the user in a restrictive jurisdiction, true anonymity is not a luxury—it is a requirement. This is where Privacy Coins enter the equation. As a blockchain engineer, I don’t trust “promises” of privacy. I trust cryptography. In this guide, we will dissect the technology behind Monero (XMR), Zcash (ZEC), and the emerging privacy protocols that allow you to gamble without leaving a digital footprint.

In This Article:

The Surveillance Machine: How They Track You

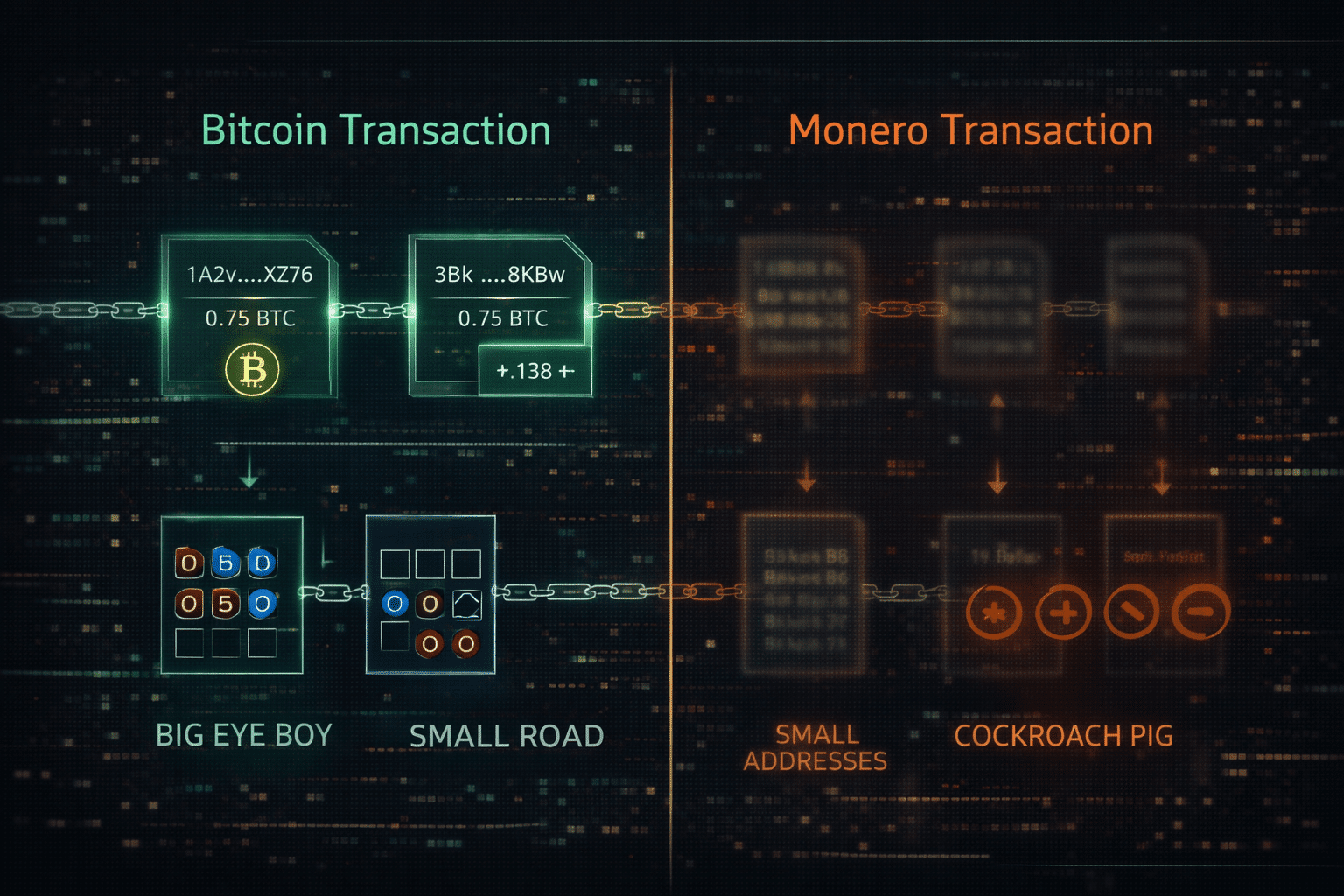

To understand the value of privacy coins, you must first understand the enemy: Chain Analysis Heuristics. When you use a public ledger like Bitcoin, Ethereum, or Solana, you are subject to several tracking methods:

1. Address Clustering

If you have 1 BTC spread across three different addresses in your wallet and you send 0.5 BTC to a casino, your wallet software might combine inputs from all three addresses to make the payment. Analytics software sees this “Co-Spend” and instantly links all three addresses to a single entity (you). The cluster grows with every transaction you make.

2. Taint Analysis

Coins carry history. If you win big at a casino that has been flagged for “high risk” or regulatory non-compliance, those coins are “tainted.” When you try to deposit those winnings into a regulated exchange to cash out for fiat, the exchange’s automated compliance bots will freeze your funds. You are guilty by association with the coins’ history.

3. The “Dust” Attack

I mentioned this in my wallet security guide, but it bears repeating in the context of privacy. Surveillance firms send tiny amounts of crypto (“dust”) to thousands of addresses. When you eventually spend that dust along with your main funds, you deanonymize yourself, allowing the tracker to link your cold storage to your hot wallet.

Monero (XMR): The Gold Standard of Digital Cash

Monero is not just another cryptocurrency; it is the only major coin where privacy is mandatory, not optional. In Monero, the blockchain is opaque. If you look at a Monero block explorer, you cannot see the sender, the receiver, or the amount sent. It is a black box.

For a gambler, Monero is the ultimate tool. Here is the math that makes it unbreakable:

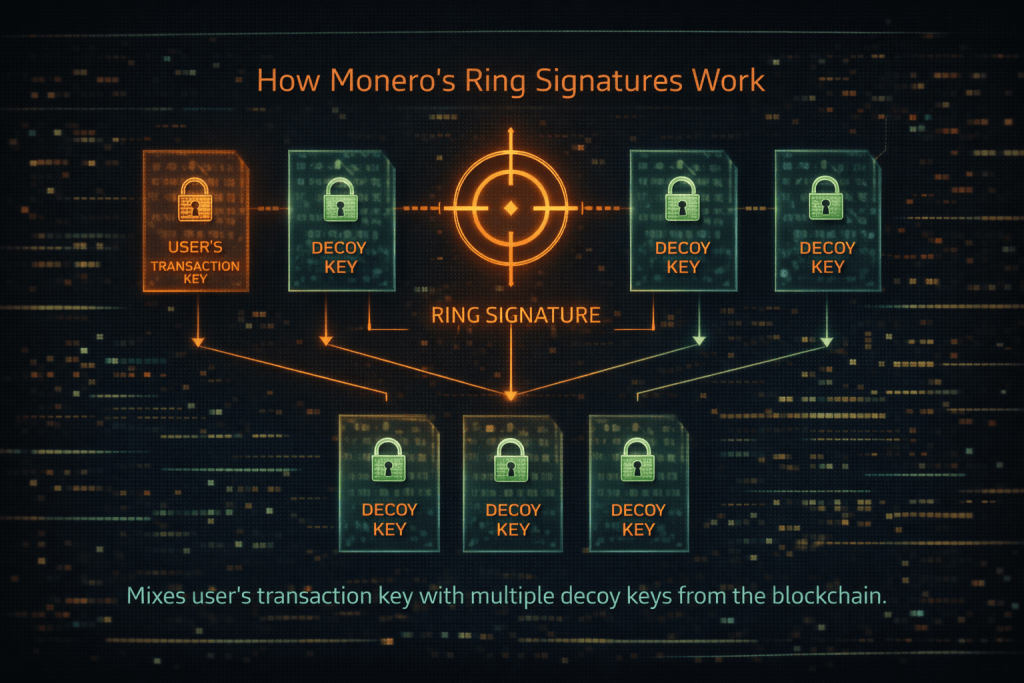

Ring Signatures (Hiding the Sender)

In a standard crypto transaction, you sign with your private key to prove you own the funds. In Monero, your signature is mixed with a group of other past transaction signatures picked from the blockchain. These are called “decoys.”

To an outside observer, it looks like any one of the group could have signed the transaction. Mathematically, it is impossible to determine which key was the true signer. The “Ring Size” (currently fixed to 16 in the latest hard fork) ensures that your transaction is indistinguishable from 15 others.

Stealth Addresses (Hiding the Receiver)

When you deposit XMR to a casino, you don’t send it to their public address. Your wallet automatically generates a unique, one-time “Stealth Address” derived from their public key. The funds go to this unique address on the blockchain.

Only the casino (the holder of the private view key) can scan the blockchain and see that the funds belong to them. An outside observer sees funds moving to a random address but cannot link it to the casino’s known public ID. This means nobody can see how much money the casino is holding or receiving.

RingCT (Hiding the Amount)

Ring Confidential Transactions (RingCT) encrypt the amount being sent. Using a cryptographic primitive called a Pedersen Commitment, the network can verify that the inputs equal the outputs (i.e., no new coins were created out of thin air) without ever revealing the actual number. You could be betting $10 or $10,000,000—the network validates the math, but the value remains a secret.

Zcash (ZEC): The Optional Privacy Trap

Zcash offers a different approach using zk-SNARKs (Zero-Knowledge Succinct Non-Interactive Arguments of Knowledge). This is cutting-edge math that allows you to prove you have the funds without revealing any information about the funds themselves.

The “T” and “Z” Addresses

Zcash has two types of addresses:

- T-Addresses (Transparent): These work exactly like Bitcoin. Everything is visible.

- Z-Addresses (Shielded): These use zero-knowledge proofs to hide transaction data.

The Problem for Gamblers

While Zcash’s technology is theoretically stronger than Monero’s, its practical application is flawed. Because privacy is optional, the vast majority of Zcash transactions are transparent. This makes the “anonymity set” (the crowd you can hide in) very small.

Furthermore, many casinos only accept deposits from T-Addresses because it is easier for their legacy systems to process. If you send from a shielded Z-Address to a transparent T-Address, you are breaking the privacy shield. For this reason, I rarely recommend Zcash for gambling unless you are strictly interacting Z-to-Z, which few casinos support.

Litecoin (LTC) and MWEB: A “Lite” Version of Privacy

Litecoin has been a staple of crypto gambling for years due to its speed and low fees. In recent years, it integrated the MWEB (MimbleWimble Extension Blocks) upgrade.

MWEB allows users to “opt-in” to a parallel chain where amounts are hidden and addresses are obfuscated. However, like Zcash, this is optional. Most casinos do not support MWEB deposits directly. You would have to bridge your LTC into the MWEB chain, move it, and then bridge it back out to a standard address to deposit. While this breaks the chain of custody for basic analysis, sophisticated heuristics can still likely trace the entry and exit points. It is better than Bitcoin, but it is not Monero.

The “Atomic Swap” Solution

The biggest hurdle for privacy coin gamblers in 2026 is acquisition. Most major centralized exchanges (CEXs) have delisted Monero due to regulatory pressure. They want to know what you are doing, and Monero doesn’t let them.

So, how do you get XMR to gamble with?

DEXs and Atomic Swaps

The solution lies in Decentralized Exchanges (DEXs) and Atomic Swaps. An Atomic Swap allows you to trade Bitcoin for Monero directly with another peer, without a third-party intermediary or a KYC check. The protocol ensures that either both parties receive their funds, or the transaction is canceled.

Tools like UnstoppableSwap or Samourai Wallet (if still operational in your region) facilitate these swaps. The workflow for the privacy-conscious gambler looks like this:

- Buy BTC or LTC on a standard exchange (like Coinbase).

- Withdraw to a non-custodial wallet.

- Perform an Atomic Swap to convert BTC to XMR.

- Deposit XMR into the casino.

- Gamble.

- Withdraw XMR.

- Swap XMR back to BTC (or a stablecoin) via a different fresh wallet.

This breaks the link completely. The exchange sees you withdrew BTC. Later, they see you deposited BTC. They have no way of knowing that in between those two events, you won a fortune at a casino.

Casino Support for Privacy Coins

Not all crypto casinos accept Monero. The ones that do usually fall into two categories:

1. Crypto-First Casinos

These are platforms built specifically for the crypto community. They often have no KYC (Know Your Customer) requirements for crypto-only players. They run their own Monero nodes and embrace the privacy ethos. These are your safest bet.

2. The “Aggregators”

Some casinos claim to accept XMR, but they use a third-party payment processor (like CoinPayments). These processors act as middlemen. When you deposit XMR, the processor receives it and credits the casino. While the blockchain part is private, you are trusting the processor’s database not to log your IP address and associate it with the transaction. Always check if the casino processes deposits in-house or via a third party.

The Risks of Privacy Coins

Is it all upside? No. There are specific risks associated with using privacy coins in gambling that you must be aware of.

Liquidity Issues

Because major exchanges have delisted XMR, liquidity can be lower than BTC. If you win $5 million in Monero, you might find it difficult to “cash out” into fiat currency quickly without moving the market or jumping through hoops. You may have to swap it back to BTC in small chunks over weeks.

Regulatory Scrutiny

In some jurisdictions, the mere possession of privacy coins is flagged as suspicious. If you try to deposit funds onto a regulated exchange and the source is traced back to an Atomic Swap or a known privacy pool, the exchange may freeze your funds pending an “Enhanced Due Diligence” check. Always keep your “clean” investment crypto separate from your “gray” privacy crypto.

Conclusion: The Right to Silence

In the digital age, financial privacy is the equivalent of the Fifth Amendment. You have the right not to incriminate yourself, and you have the right not to broadcast your spending habits to the world.

Bitcoin is a public announcement. Monero is a whisper. If you are serious about crypto gambling—whether for security, strategy, or simple peace of mind—you need to graduate from transparent ledgers to opaque ones. The math of Ring Signatures offers a shield that no Terms of Service or regulatory body can penetrate. Use it wisely, use it responsibly, but above all, use it to keep your business yours.

FAQ: Anonymous Gambling

Is Monero gambling legal?

Gambling laws depend on your jurisdiction, not the currency. Using Monero is generally legal in most parts of the world, though some exchanges are banned from listing it. Gambling with it follows the same laws as gambling with Bitcoin or Fiat in your country.

Can I verify a Monero transaction if the casino claims they didn’t get it?

Yes. This is a common myth. Monero has a “Tx Key” (Transaction Key) stored in your wallet history. You can give this key to the casino support. It allows them (and only them) to decode that specific transaction on the blockchain and prove that you sent the funds, without revealing your other history.

Why is Monero slower than Solana or Ripple?

Privacy is heavy. The cryptographic proofs required for RingCT and Ring Signatures take up more data space and require more computational power to verify than a simple transparent transaction. Monero blocks are mined every 2 minutes. You sacrifice speed for invincibility.

What is the difference between a Mixer and a Privacy Coin?

A Mixer (like Tornado Cash) takes transparent coins (ETH/BTC), jumbles them up in a pool, and sends them out to new addresses. However, Mixers are centralized targets and often sanctioned. A Privacy Coin like Monero has the “mixing” built into the protocol itself at the protocol level. It is decentralized and cannot be “shut down” without shutting down the internet.

Does using a VPN make Bitcoin anonymous?

No. A VPN hides your IP address, but it does not hide the flow of funds on the blockchain. If you pay with a wallet linked to your ID, the VPN does nothing to stop Chainalysis from tracing the money. You need both a VPN (for network privacy) and a Privacy Coin (for financial privacy) to be truly anonymous.