The single most frustrating moment in online gambling is not losing a bet. It is winning a bet, clicking “Withdraw,” and receiving an email asking for a photo of your passport, a utility bill, and a selfie holding today’s newspaper.

This is Know Your Customer (KYC). To the player, it feels like an invasion of privacy designed to stall payment. To the operator, it is a binary legal requirement. If they do not verify you, the Malta Gaming Authority (MGA) or the UKGC will fine them millions. However, there is a nuance.

I have worked with Compliance Teams that use KYC as a weapon. They weaponize “blurry photos” to delay payouts, hoping you will get frustrated, cancel the withdrawal, and gamble the money back. This is known operationally as “Friction churn.”

At Casino545, we believe that data preparation is your only defense. This article is a comprehensive audit of the 2026 Verification Landscape. I will explain how the AI scanning software works, how to trigger “Soft KYC” instead of “Hard KYC,” and how to navigate the nightmare scenario: the Source of Wealth (SOW) audit.

Compliance Log: Jump to Section

- 1. The Mandate: Why Casinos Need Your ID

- 2. Soft KYC vs. Hard KYC: The Invisible Check

- 3. Document Standards: Why You Get Rejected

- 4. Inside the Tech: Jumio, Sumsub & HooYu

- 5. Source of Wealth (SOW): The €2,000 Trigger

- 6. Crypto Casinos: The Myth of Anonymity

- 7. Data Safety: Is It Safe to Send My Passport?

- 8. Tool: Verification Rejection Troubleshooter

- 9. Red Flags: When to Refuse KYC

- 10. Frequently Asked Questions

1. The Mandate: Why Casinos Need Your ID

You are not sending your ID to the casino. You are essentially sending it to the regulator. In 2026, Anti-Money Laundering (AML) laws are draconian. Casinos are treated like banks.

The Three Pillars of Compliance:

- Age Verification: Preventing minors from gambling. This is the only check that happens immediately upon signup in strict jurisdictions (UK, Ontario).

- Identity Verification (AML): Ensuring you are who you say you are, and that you are not on a sanctions list (e.g., a Politically Exposed Person).

- Payment Ownership: Ensuring the credit card used matches the name on the account. This prevents stolen credit card usage.

If a casino lets you withdraw without KYC, they are either an unregulated crypto site (risky) or they are breaking the law. There is no middle ground.

2. Soft KYC vs. Hard KYC: The Invisible Check

Smart players know how to stay in the “Soft KYC” zone.

Soft KYC (The Background Check)

When you register, the casino runs your Name, Address, and Date of Birth against public databases (Electoral Roll, Credit Agencies). This happens in milliseconds via API.

Operational Note: If you type your address slightly differently than it appears on your bank statement (e.g., “St.” vs “Street”), the API match might fail, forcing you into Hard KYC immediately. Always use the exact formatting of your utility bill when signing up.

Hard KYC (The Document Request)

This is triggered by specific events:

1. Cumulative withdrawals exceeding €2,000 (The MGA Threshold).

2. Changing payment methods (e.g., depositing with Visa, withdrawing to Skrill).

3. Logging in from a different IP address (Suspicious Activity).

4. Random Audit (usually 5% of players).

3. Document Standards: Why You Get Rejected

I have audited the logs of rejected documents. 80% of rejections are automated by AI, not humans. The AI is looking for specific geometric markers. If it cannot find them, it rejects the image instantly.

The “Four Corners” Rule

The most common rejection reason. You take a photo of your passport, but your thumb covers the corner, or the edge is cut off.

The Fix: The photo must show all four corners of the document. Place the document on a contrasting background (e.g., a white passport on a black table).

The “Glare” Problem

Passports are glossy. Flash photography creates a white spot that obscures data.

The Fix: Do not use flash. Use natural light near a window.

Utility Bill Aging

A “Proof of Address” must be dated within the last 90 days.

The Trap: Electronic PDF bills are often accepted, but screenshots of mobile banking apps are rejected. You must download the official PDF statement. A screenshot lacks the metadata required for verification.

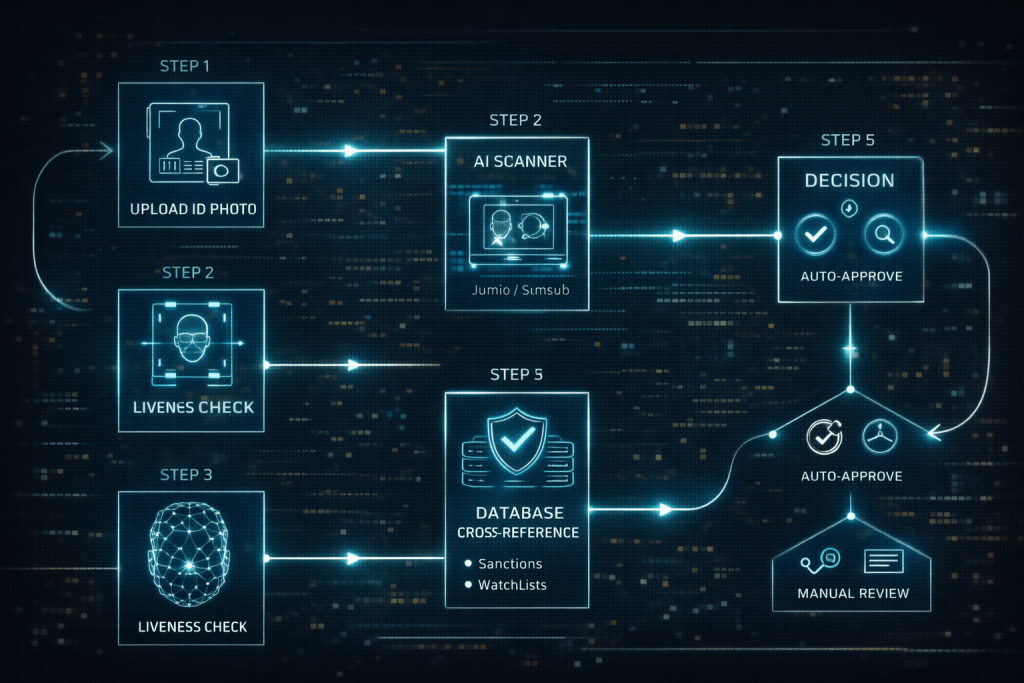

4. Inside the Tech: Jumio, Sumsub & HooYu

Casinos do not verify your ID manually. They pay third-party API providers like Jumio, Sumsub, or Veriff. These are multi-billion dollar identity companies.

The Liveness Check:

Many casinos now ask you to look at your webcam and “turn your head” or “move closer.” This is a 3D Liveness Check. It maps the biometrics of your face to ensure you are a real human and not a photo held up to the camera.

Operational Tip: If the Liveness Check fails, clean your camera lens. Smudges refract light and confuse the 3D mapping algorithm.

5. Source of Wealth (SOW): The €2,000 Trigger

This is the stage where most high-rollers quit. If you deposit large sums or win big, the casino is legally required to ask: “Where did you get this money?”

They are verifying that your gambling spend is proportionate to your income. This is not just AML; it is also “Responsible Gambling” enforcement.

Documents they will demand:

- Salary Slips: Usually the last 3 months.

- Bank Statements: Showing the salary entering your account.

- Sale of Assets: If you sold a house or crypto, you need the contract or ledger proof.

- Inheritance: Legal letters.

The Privacy Concern: Players hate this. But if you refuse, the casino must freeze your funds. They cannot legally pay you. My advice: If you plan to play high stakes, have a folder on your computer named “Casino KYC” with redacted bank statements ready to go.

6. Crypto Casinos: The Myth of Anonymity

In 2026, “No KYC” crypto casinos are an endangered species. Even Curacao-licensed sites are tightening up.

The “Trigger” Point:

A crypto casino might let you deposit and play without ID. But the moment you click “Withdraw,” the system analyzes your risk score. If you used a VPN, or if your wallet address is associated with a “Mixer” (like Tornado Cash), you will be flagged for Enhanced Due Diligence (EDD).

True Anonymity: Only exists on decentralized casinos (dApps) running entirely on smart contracts. If you are playing on a centralized site (Stake, Roobet, BC.Game), you will eventually be asked for ID.

7. Data Safety: Is It Safe to Send My Passport?

This depends on the transmission method.

Safe: Uploading directly to a secure portal (HTTPS) inside the casino dashboard. The data goes directly to the processor (Jumio/Sumsub). The casino staff often only see a “Verified” tick, not the raw document.

Unsafe: Emailing your passport to support@casino.com. Email is not encrypted at rest. Support agents can download the file. Never do this. If a casino asks for documents via email, they are violating GDPR and PCI-DSS standards.

8. Tool: Verification Rejection Troubleshooter

Is your document getting rejected repeatedly? Use this logic tool to find the operational error.

🕵️ verification Troubleshooter

What is the rejection reason given? “Document edges not visible” “Poor quality / Glare” “Data does not match account” “Document expired or too old” “Screenshots not accepted” Diagnose Issue

9. Red Flags: When to Refuse KYC

While verification is standard, some requests are predatory or dangerous. If a casino asks for these, do not comply.

1. The “Selfie with Credit Card” (Back Side)

Casinos need to verify you own the card. They will ask for a photo of the front (first 6 and last 4 digits visible). Never show the CVV (the 3 digits on the back). If they ask for an uncovered photo of the back of your card, they are compromised. Block the card immediately.

2. Notarized Documents for Small Amounts

If you are withdrawing €100 and they ask for a notarized (stamp from a lawyer) copy of your passport, this is a stalling tactic. Notarization costs money and time. They are hoping you will give up.

3. “Deposit to Verify”

If a casino says, “Your account is frozen. Please deposit another €100 to verify your payment method so we can release your €500,” this is a scam. Never deposit to withdraw.

10. Frequently Asked Questions

How long should verification take?

In 2026, with AI automation, standard ID verification should take under 15 minutes. If it takes longer than 24 hours (on a weekday), the casino is manually reviewing it or stalling.

Can I black out information on my bank statement?

Yes. You can (and should) redact your account balance and other transactions. The casino only needs to see: The Logo, Your Name, Your Address, The Date, and the IBAN/Account Number.

Why do I need to verify if I use crypto?

Because crypto exchanges are now regulated. If the casino suspects your coins come from a dark web source or a hacked wallet, they are obligated to freeze the funds and request KYC to clear the “Risk Flag.”

What if I don’t have a Utility Bill in my name?

This is common for younger players living with parents. You can usually provide a “Government Letter” (tax letter, benefits letter) or a Bank Statement sent to that address. Some casinos accept a “Mobile Phone Bill,” but many do not (as mobile billing addresses are easily faked).

Is my data deleted if I close my account?

No. Under AML laws, casinos are required to keep your data for 5 to 10 years after the business relationship ends. This is a legal requirement, not a casino choice. However, the data must be “archived” and not accessible to general staff.

What is a “PEP” check?

PEP stands for Politically Exposed Person. The KYC system checks if you are a politician, diplomat, or close relative of one. PEPs are considered “High Risk” for bribery and money laundering and undergo stricter checks.