Tarafından Elena Petrova

Modern slot mekaniklerinin manzarasında, “Feature Buy” veya “Bonus Buy” olarak bilinen birkaç yenilik, oyuncu davranışlarını bu kadar köklü bir şekilde değiştirmiştir. Big Time Gaming tarafından öne çıkan White Rabbit ile tanıtılmış ve Nolimit City ve Pragmatic Play gibi stüdyolar tarafından agresif bir şekilde popülerleştirilmiştir. Bu mekanik, oyuncuların temel oyunu tamamen atlamasını sağlar. Ücret ödersiniz – genellikle 100 katı bahsiniz – ve hemen Ücretsiz Dönüşler turunu tetiklemiş olursunuz.

Pazarlama ekipleri bunu “Anlık Eylem” olarak sunuyor. Oyuncular bunu jackpot’a giden bir kestirme yol olarak görüyor. Ama bir matematikçi olarak, bunu farklı görüyorum. Sabit bir primle volatiliteleri satın aldığınız bir işlem olarak görüyorum. Eğer işin içine dalarsak, İflas Olasılığında belirgin bir değişim görüyorum. Teorik kayıp oranını saatlerden dakikalar seviyesine hızlandıran bir mekanik görüyorum.

Bir Bonus Buy’ın “değerli olup olmadığını” anlamak için heyecanı bir kenara bırakmalı ve ham rakamlara bakmalıyız. Giriş maliyetini, ayarlanmış RTP’yi, satın alınan özelliğin varyansını ve başa baş olma olasılığını analiz etmemiz gerekiyor. Bu kapsamlı analizde, Bonus Buy’ın matematiğini inceleyeceğim.

Bu Yazıda:

Temel Denklem: Maliyet vs. Beklenen Değer (EV)

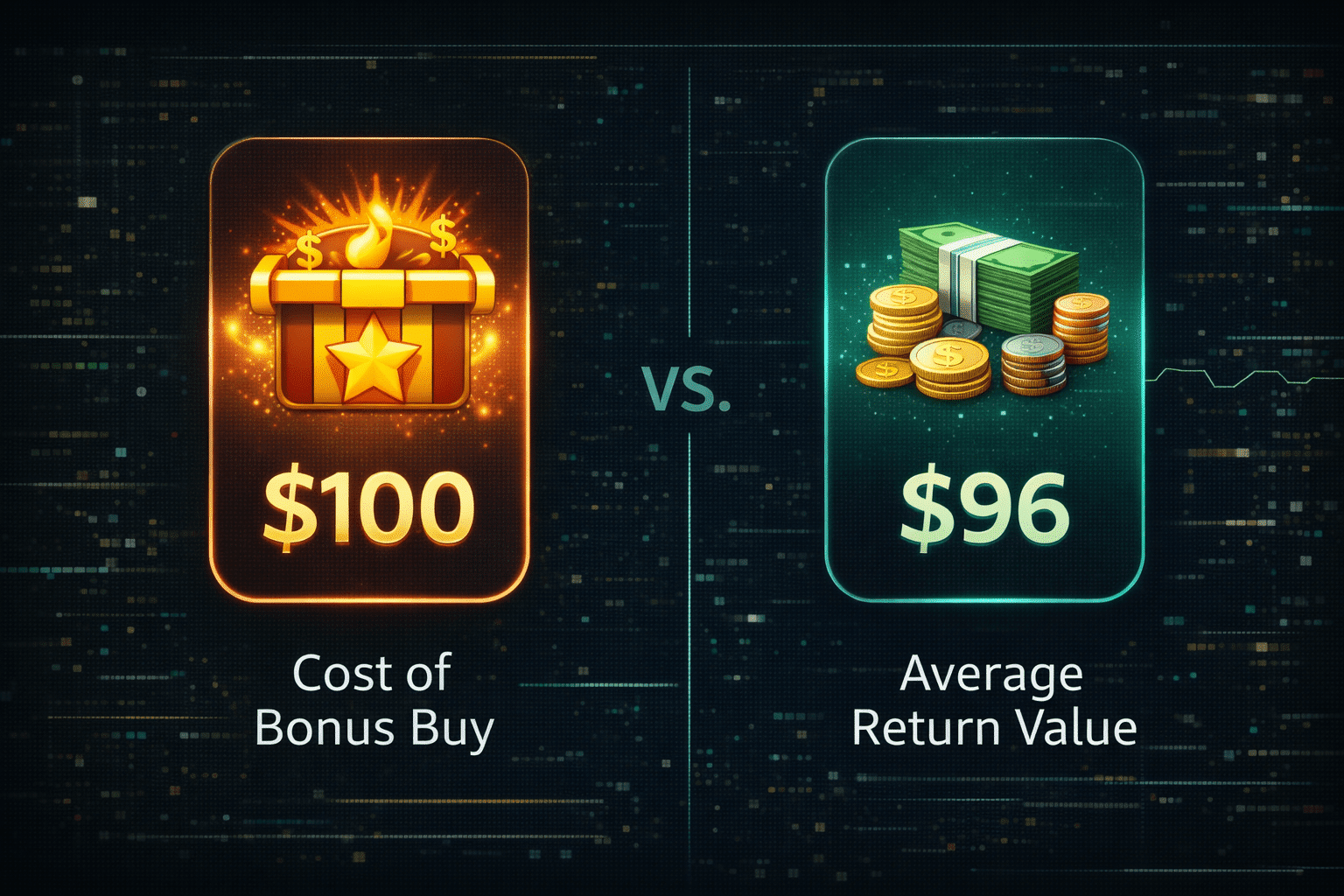

Analizimizdeki ilk değişken fiyat etiketidir. Bir Bonus Buy için endüstri standardı, temel bahsin 100 katıdır. Eğer 1,00 $ bahis yapıyorsanız, özellik 100,00 $’dır.

Gündelik bir oyuncu için bu sadece bir rakamdır. Bir analist için bu “Engel Oranı”dır. O satın alma butonuna tıkladığınızda, hemen -100 birimlik bir açıkla karşılaşırsınız. İşlemin karlı olması için özellik 101 birim veya daha fazlasını geri döndürmelidir.

Başabaş Olasılığı

İşte matematik zorlayıcı hale geldiği yer. Yüksek volatiliteye sahip bir slotta, “Ortalama Bonus Kazancı” genellikle “Bonus Satın Alma Maliyeti”nden daha düşüktür.

Hayali bir yüksek varyans slotuna bakalım:

- Bonus Maliyeti: 100x

- Ortalama Organik Bonus Ödemesi: 60x – 80x

Doğru okudunuz. Birçok makinede, bonus turunun matematiksel ortalama getirisi daha azdır, çünkü ödemeniz gereken fiyatın altında kalır. Neden? Çünkü ortalama, büyük anomaller (50,000x kazançlar) tarafından ciddi şekilde çarpıtılmıştır. 50,000x kazanan bir oyuncunun yanında, matematiği dengelemek için on binlerce oyuncunun 15x veya 20x kazanması gerekir.

Simülasyonlarımda, 100x bonus satın almaları üzerindeki “Başabaş Oranı” genellikle %15 ile %20 civarındadır. Bu, bonus aldığınızda her 10 seferden yaklaşık 8’inde işleminizden zarar edeceğiniz anlamına gelir. Anomaliler için bir şans için prim ödüyorsunuz, garantili bir getiri için değil.

RTP Değişimleri: Satın Alma Teşviki

Oyuncuları bu yüksek riskli bahse teşvik etmek için, geliştiriciler sıklıkla matematik modelinde ayarlamalar yaparlar. Birçok oyunda, Bonus satın aldığınızda, temel oyun oynamaya göre Oyuncuya Dönüş (RTP) biraz daha yüksektir.

İstatistiksel Artış

Relax Gaming’in Money Train 2 oyununu ana örnek olarak inceleyelim:

- Temel Oyun RTP: %96.40

- Özellik Satın Alma RTP: %98.00

Matematiksel açıdan, bonus satın almak saf RTP açısından “daha akıllıca” bir oyun. Ev Avantajını %3.6’dan %2.0’a düşürüyorsunuz. Sonsuz döndürme (milyarlarca) üzerinden bonus satın almak, daha iyi bir getiri sağlıyor.

Ancak, bunun büyük bir uyarısı var: Varyans. RTP daha yüksek olmasına rağmen, her olay için oynama maliyeti 100 kat daha fazladır. “Cihazda Geçirilen Zaman” kısıtlanıyor. 300 dönüşlük bahsi 30 saniyelik bir olaya sıkıştırıyorsunuz. Ev Avantajı daha düşük olsa da, “Kayıp Hızı” katlanarak artıyor. 98% RTP ile bile üç tıklamada tüm bakiyenizi kaybedebilirsiniz.

Satın Almanın Volatilitesinin Değerlendirilmesi

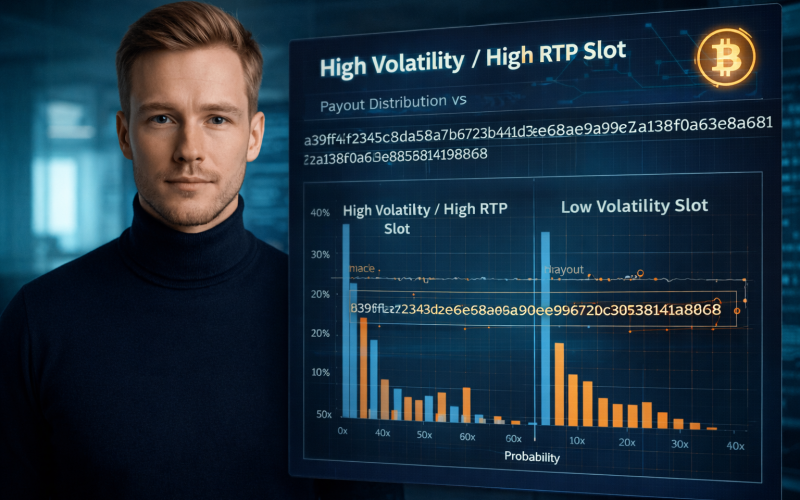

Temel oyunu oynarken, “dönüşüm” yaşarsınız. Bakiyenizi sürdüren küçük miktarlar (1x, 2x, 5x) kazanırsınız. Bu düşük varyanslı bir etkinliktir. Bir bonus satın aldığınızda, “Yüksek Varyans Bölgesine” girersiniz.

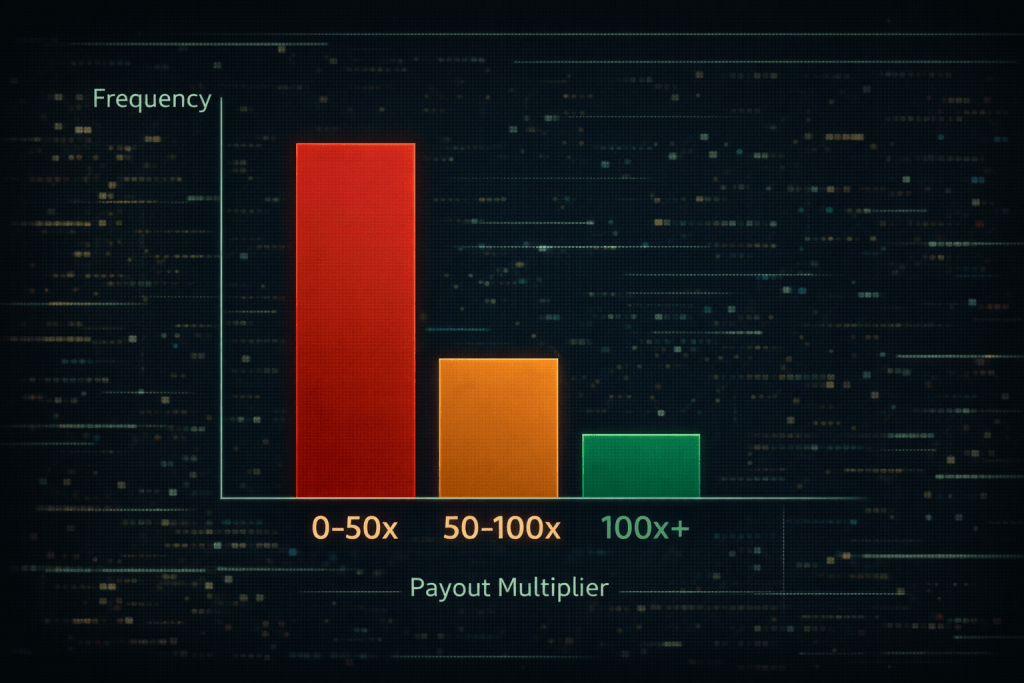

Bonus Satın Almadaki sonuçların dağılımı çan eğrisi değildir; bu bir “Güç Yasası” dağılımıdır. Bu, sonuçların büyük çoğunluğunun düşük uçta (0x ile 50x arasında) toplandığı, maksimum kazanca doğru uzanan uzun, ince bir kuyruğa sahip olduğu anlamına gelir.

“Ölü Bonus” Fenomeni

“Ölü Bonus”, maliyetinin %10’undan daha azını ödeyen bir özellik anlamına gelir. 100x satın alma senaryosunda, bu, 10x’den daha az kazanmak anlamına gelir.

Gates of Olympus veya Sweet Bonanza gibi slotlarda, Ölü Bonusun olasılığı oldukça yüksektir. Matematik, çarpan mekanikleri üzerine kuruludur. Çarpanlar düşmezse, sembol değerleri yalnızca 100x maliyeti karşılamak için yetersizdir. $100 ödeyebilir ve $4.50 kazanabilirsiniz. Bu bir hata değildir; bu, maksimum kazanç potansiyelini finanse etmek için standart sapmanın amacına uygun çalışmasıdır.

Vaka Çalışması: “Aşırı” Satın Almalar (Nolimit City)

He hiç geliştirici, Bonus Satın Almanın matematiğini Nolimit City kadar ileriye götürmedi. Katmanlı satın alımlar sunarak, “Tanrı Modu” veya eşdeğer özelliklerle zirveye ulaşmışlardır.

San Quentin xWays Matematik Analizi

Bu oyun, 2,000x stake satın alma seçeneği sunar. Eğer $1 yatırırsanız, özellik maliyeti $2,000’dır.

Matematiksel açıdan bakıldığında, bu durum %99.9’u için bir absürtlük. Buradaki varyans astronomik. 2000x satın alımında kar elde etme “Vuruş Sıklığı” inanılmaz derecede düşüktür. Temel olarak tek bir ikili sonuca bahis yapıyorsunuz: Maksimum kazanç ayarına ulaştım mı? Evet mi Hayır mı.

Eğer cevap “Hayır” ise, sermaye kaybı tamdır. 100x veya 200x geri alabileceğiniz bir durumda, bu büyük bir kazanç gibi hissettirse de, 2000x maliyeti bağlamında, %90’lık yıkıcı bir sermaye kaybıdır. Bu satın almalar, 2000x’a kadar 50 peş peşe kayıp yaşayabilen yayıncılar ve yüksek net değerli oyuncular için özel olarak tasarlanmıştır. Standart oyuncu için, iflas riski neredeyse hemen %100’e yaklaşır.

Özellik Satın Alımları İçin Kumarbazların Yanılgısı

Bonus Satın Alımlarıyla bağlantılı olarak oyuncuların yaptığı en tehlikeli matematiksel hata, “Gömülü Maliyet Yanılgısı” ile “Kumarbazların Yanılgısı”nın birleşimidir.

Yanılgı: “4 bonus satın aldım ve hepsi 20x ödedi. Bir sonraki kesinlikle büyük ödemek zorunda.”

Matematik: Rastgele Sayı Üreteci (RNG) hafızaya sahip değildir. Her işlem bağımsız bir olaydır. Oyun sizin 400x kayıpta olduğunuzu bilmez. Sonraki bonusun 20x ödemesi olasılığı, önceki dört bonusun olasılığı ile tam olarak aynıdır.

Masraf bu kadar yüksek olduğunda (100x), insan beyni kaybı kabul etmekte zorlanır. Temel oyunda, 10 döndürme kaybetmek (10$) sinir bozucudur ama yönetilebilir. 4 alım kaybetmek (400$) kayıpları geri kazanmak için psikolojik bir çaresizlik tetikler. Bu da “Tilt” durumuna yol açar; oyuncular bahisciklerini artırır veya daha hızlı alım yapar, matematiksel gerçekliği göz ardı ederek variance’in kendilerine bir düzeltme borçlu olmadığını unutur.

Bankroll Yönetimi: 100 Alım Kuralı

Bonus Alım mekanikleri ile uğraşmayı seçerseniz, standart bankroll yönetim stratejilerini (örneğin 100 bahse sahip olmak) kullanamazsınız. “Birim Ücreti” esasına dayanan bir stratejiye ihtiyacınız var.

Eğer birim ücreti 100x ise, bankroll’unuz bu birime göre belirlenmelidir.

- Gündelik Strateji: 10 Alımın Bankroll’u (İflas Riski: Aşırı Yüksek).

- İhtiyatlı Strateji: 50 Alımın Bankroll’u (İflas Riski: Orta).

- Profesyonel Strateji: 100+ Alımın Bankroll’u (İflas Riski: Düşük).

Çoğu oyuncu, sadece 2 veya 3 alım için yeterli bir bankroll ile bir seansa girer. Matematiksel olarak bu, saf bir kumar. Tamamen kısa vadeli şansa bağlısınız. En az 50 alım büyüklüğünde bir örneklem olmadan teorik RTP’ye yaklaşmayı umamazsınız. Büyük olasılıkla “Variance Vadisi”ne düşersiniz—500x kazanımı ortaya çıkmadan önce fonlarınızı tüketen 20x ile 50x arasında uzun bir uzantı.

Regülatif Etkiler: Neden Birleşik Krallık Bunu Yasakladı

Birleşik Krallık Kumar Komisyonu (UKGC) Bonus Alım özelliğini tamamen yasakladığını belirtmekte fayda var. Neden? Matematiğe baktılar.

Bu mekanizmanın oyunun şiddetini tehlikeli seviyelere artırdığını belirlediler. “Kayıp Hızı” sorumlu kumar önlemlerinin etkili bir şekilde takip etmesi için çok yüksektir. Bir oyuncu, Bonus Alımlar kullanarak 4 dakikada bir ay maaşını kaybedebilir, oysa bunu temel oyunda 4 saat sürmesi gerekebilir.

Ama Malta (MGA) veya Curacao gibi yargı bölgelerinde bu özellik yasal kalmaktadır. Eğer MGA lisansı altında oynuyorsanız, bu araçlara erişiminiz vardır, ancak matematiği anlama sorumluluğu tamamen sizin üzerinizdedir.

Organik Tetikleyiciler vs. Satın Alınan Tetikleyiciler: Fark Var mı?

Yaygın bir mit, “Organik” bonusların (temel oyunda dağılma düştüğünde tetiklenen) “Satın Alınan” bonuslardan daha iyi ödendiğidir.

Matematiksel olarak, %95’lik makinalarda fark yoktur. Oyun motoru, bonus turuna girişi nasıl yapmış olursanız olun, aynı makaraları ve aynı mantığı kullanır.

Fark tamamen psikolojik (ve finansaldır).

Senaryo A (Organik): Boni tetiklemek için 40$ harcadınız. 80$ kazandınız. Kar: 40$. Sonuç: Mutluluk.

Senaryo B (Alım): Aynı bonusa ulaşmak için 100$ harcadınız. 80$ kazandınız. Zarar: 20$. Sonuç: Hayal kırıklığı.

Dönüşlerin sonucu identikti (80$). Giriş maliyeti, başarı algısını belirliyordu. Bu yüzden organik tetikleyiciler genelde “daha iyi hissedilir”—genellikle onları sabit 100x primden daha düşük bir birikimli maliyetle tetiklemiş olursunuz.

“Ante Bahsi” Alternatifi

Pragmatic Play gibi birçok geliştirici, “Ante Bahsi” veya “Çifte Şans” adı verilen orta yol sunuyor. Dağılanları yakalama şansınızı iki katına çıkarmak için döndürme başına %25 daha fazla ödersiniz.

Matematiksel olarak, bu sınırlı bankroll olan oyuncular için genellikle daha üstün bir stratejidir. Özelliğin Vuruş Sıklığını artırırken 100x lump sum ödeme riskinin felaket riskinden kaçınmasını sağlar. Oynama süresini biraz uzatır, hala bonus özelliğini agresif bir şekilde kovalarken değişkenlik eğrisini düzleştirir.

Sonuç: Prim Verimlilik İçin, Kar İçin Değil

“Özelliği Satın Al” butonuna tıkladığınızda, verimlilik için ödüyorsunuz. Temel oyundaki sıkıcı kaybeden döndürmeleri atlamak için para veriyorsunuz. Heyecan kiralıyorsunuz.

Ama verimliliği kârlılıkla karıştırmayın. Bonus Alım matematiği acımasız olacak şekilde tasarlanmıştır. Yüksek primler, kazanç dağılımının güç yasası ile birleştiğinde, çoğu alımın kayıpla sonuçlanmasını garanti eder.

50+ alım sürebilecek bir bankroll’unuz varsa ve 1/1000 dışlayıcı olayı yakalamaya çalıştığınızı anlıyorsanız, devam edin. Ama son 100$’ınızla bir bonus alıyorsanız ve bir mucize bekliyorsanız, sizi mahvedecek şekilde tasarlanmış bir matematiksel kesinliğe karşı savaşıyorsunuz.

Sıkça Sorulan Sorular

Bonus satın aldığımda RTP her zaman daha iyi mi?

Çoğu durumda, evet. Geliştiriciler, RTP’yi %0.5’ten %1.5’e kadar artırarak alımı teşvik eder. Örneğin, u003cemu003eWhite Rabbitu003c/emu003e BTG tarafından %97.24’ten %97.77’ye fırlar. Ancak bu teorik getirideki küçük artış, kısa vadeli volatilitenin ve iflas riskinin büyük artışını dengelemez.

100x Bonus Alımın ortalama getirisi nedir?

Teorik ortalamanın 100x’e (ev sahibi payı çıkarıldığında) yakın olması gerekirken, u003cemu003emedyanu003c/emu003e geri dönüş genellikle çok daha düşüktür, çoğunlukla 40x ile 60x arasında. Ortalama, nadir büyük kazançlarla yukarı çekilir. Çoğu oyuncu, alımın maliyetinin çok altında getiriler görecektir.

Bir casino bonusunu Feature Buys oynamak için kullanabilir miyim?

Genellikle hayır. Çoğu çevrimiçi casino, bonus fonlarının (şans parası) özellik satın almak için kullanılmasına kesinlikle izin vermez. Bunu yapmak genellikle u0022düzensiz oyunu0022 olarak sınıflandırılır ve kazançlarınızın el konulmasına yol açabilir. Satın almadan önce her zaman bonusun şartlarını ve koşullarını kontrol edin.

Hangi slotlar en ucuz Bonus Buys’a sahip?

100x standart iken, bazı eski oyunlar veya spesifik geliştiriciler 50x, 70x veya 80x ile satın alma seçeneği sunmaktadır. Örneğin, Iron Dog Studio veya Hacksaw Gaming tarafından yapılan bazı slotlar, daha düşük maliyetle daha düşük volatiliteye sahip bir bonus satın almanıza olanak tanıyan aşamalı alımlar sunmaktadır (örneğin, 60x).

Neden yayıncılar Bonus Buys’ta bu kadar sık kazanıyor?

Bu, u0022Hayatta Kalma Yanlılığıu0022 olarak bilinen bir seçim yanlılığıdır. Yayıncılar saatlerce oynar ve yüzlerce bonus satın alırlar. YouTube’da sadece u0022Büyük Kazançu0022 kliplerini görürsünüz. O klibi önceleyen 6 saatlik başarısız alımları ve kayıplar için harcanan binlerce doları görmezsiniz. Beklentilerinizi öne çıkan derlemelere dayandırmayın.